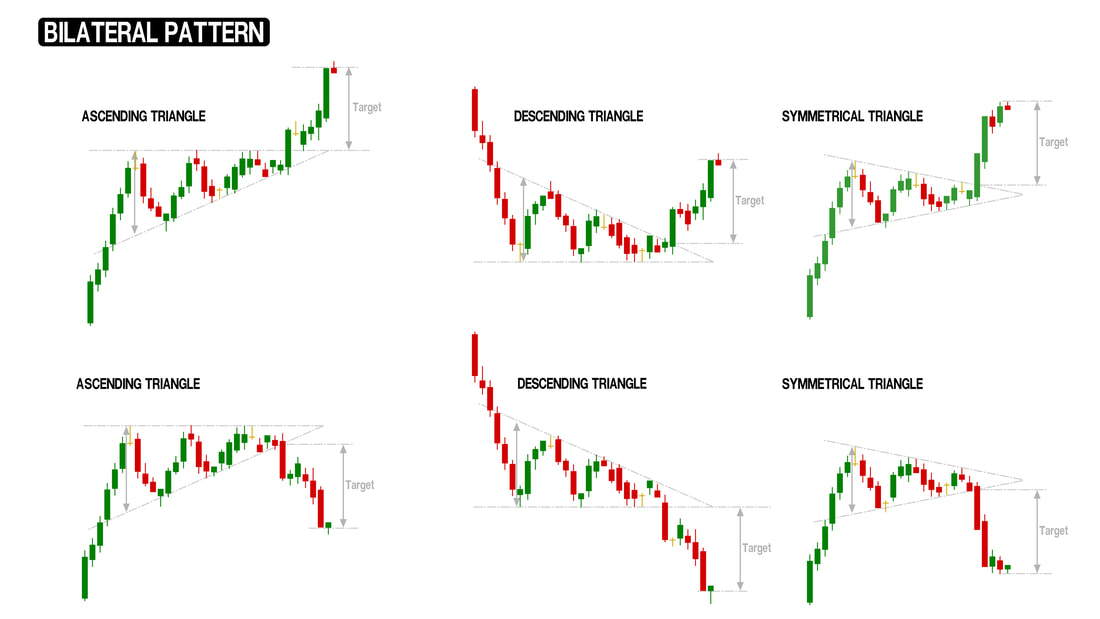

At the end of this pattern, if the price breaks resistance a breakout is likely. Support line will be a mirror image of the resistance line. Both the trendlines – support, and resistance lines will move towards each other formingĪ symmetrical triangle as shown in the below image. Now let us discuss symmetrical triangle pattern.Ī symmetrical triangle is a rare phenomenon. Similarly, a line connecting all the lows is called a support line.Ī trendline can move in all three possible directions: The line connecting all the peaks is called a resistance line. To understand symmetrical triangles pattern, you should know what is a trend line.Ī trend line is one that connects all the peaks or all the lows. W pattern indicates a likely bullish trend – A reason to buy or at least hold a stock.

#STOCK CHART PATTERNS HOW TO#

Since this pattern is a mirror image of the “head and shoulders top”, you should know how to interpret. After the third low, the prices will break the neckline and begin to rise.A low with two higher-lows on either side.This pattern is a mirror image of the previous “TOP” pattern. After the third peak, the prices will break the neckline and fall further down.Ī “head and shoulders top” pattern denotes a trend reversal.You can draw an imaginary line (neckline) passing through the troughs.You will find two lows between the three peaks.You will see a central peak and two smaller peaks on either side.If you see below three aspects in a chart, you can call it a “head and shoulders – top” pattern. Let us begin to discuss the patterns, one-by-one. There will also be instances when the trend will be more or less straight.) And if the price drops with time, you can call it a falling trend. If the price moves higher with time, you can call it a rising trend. A trend is the direction of price movement. (If you do not know what is a trend, here is your answer. Primary Use Of Chart PatternsĪll stock chart patterns try to answer one question – whether a trend will continue or reverse. Thus you will be in a better position to decide on buying, selling or holding your stocks. Whenever you look at any chart, your mind will automatically visualize a pattern. You will see great results if you remember each and every pattern.

They have come up with at least 24 chart patterns and interpretations.

Many data scientists have already done the tough part for you. Luckily, you do not have to do the research. In short, the principle behind chart analysis is this: History Repeats Itself! If you predict future with reasonable accuracy, you can make decisions on whether to hold a stock or sell it.

Many researchers have found success in predicting future stock prices based on past. Introduction: What Are Stock Chart PatternsĬhart patterns are shapes assumed by price charts. Introduction: What Are Stock Chart Patterns.You will learn hto identify and interpret each of the patterns. Then you will find explanations for 24 important stock chart patterns. First few topics carry basic knowledge regarding charts. A sound knowledge is necessary to predict price movements with reasonable accuracy.īelow is a table of contents for all the topics in this post. Technical analysis is a broad topic with so many different types of calculations and analysis. No one can predict future with hundred percent accuracy. The technical analysis predicts future price movements based on past data. If you are new to technical analysis, here is a simple explanation.

0 kommentar(er)

0 kommentar(er)